🏦 Data Bank – Customer & Transaction Analysis

SQL-Based Financial Data Analytics Project

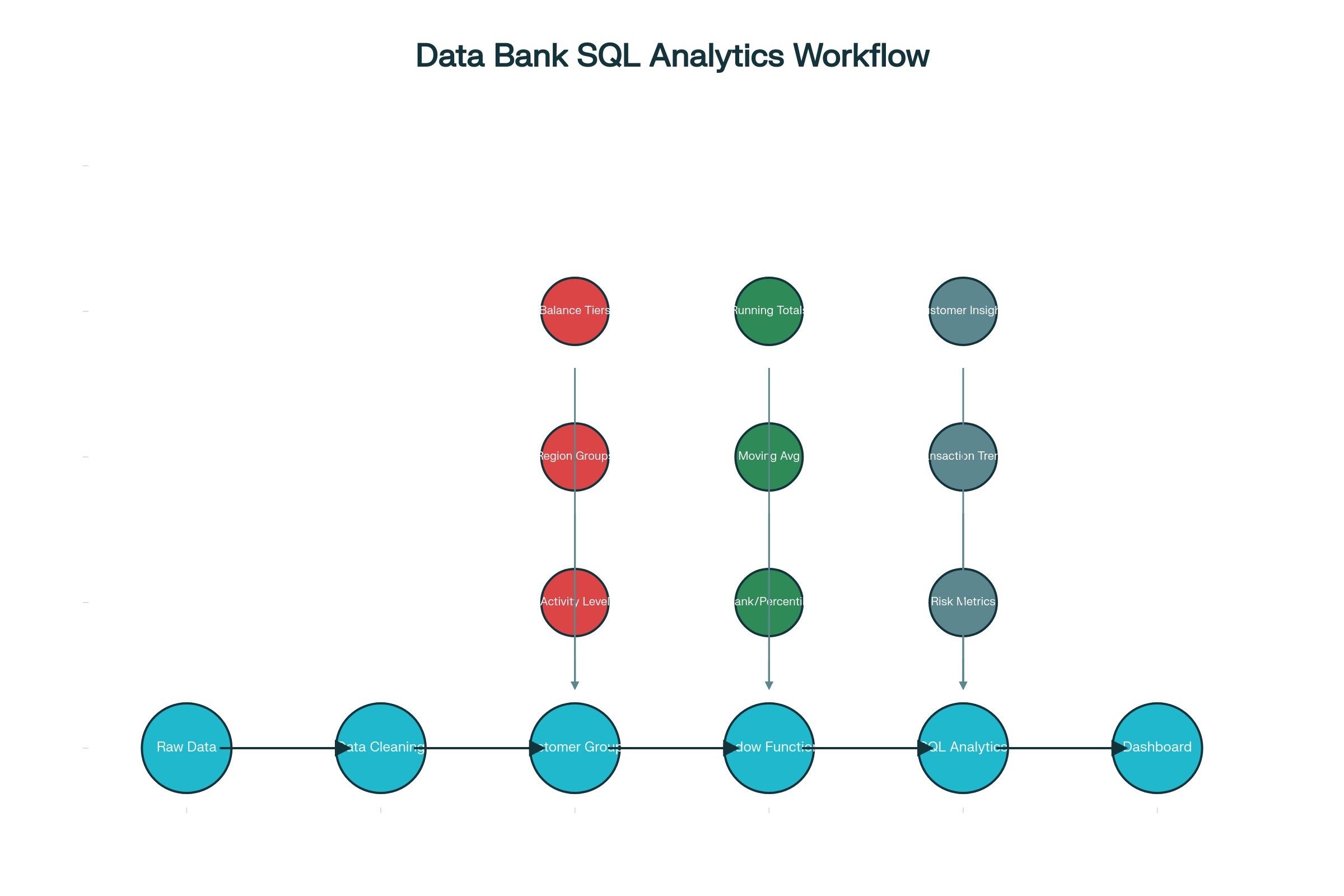

The Data Bank project focuses on analyzing customer behavior, account performance, and transactional data to drive better financial insights. Using advanced SQL techniques such as window functions, joins, and time-based aggregations, this project uncovers trends in customer growth, deposits, and engagement across banking services. The analysis supports the bank’s strategic goals of improving retention and optimizing branch performance.

Project Highlights

About the Project

Overview

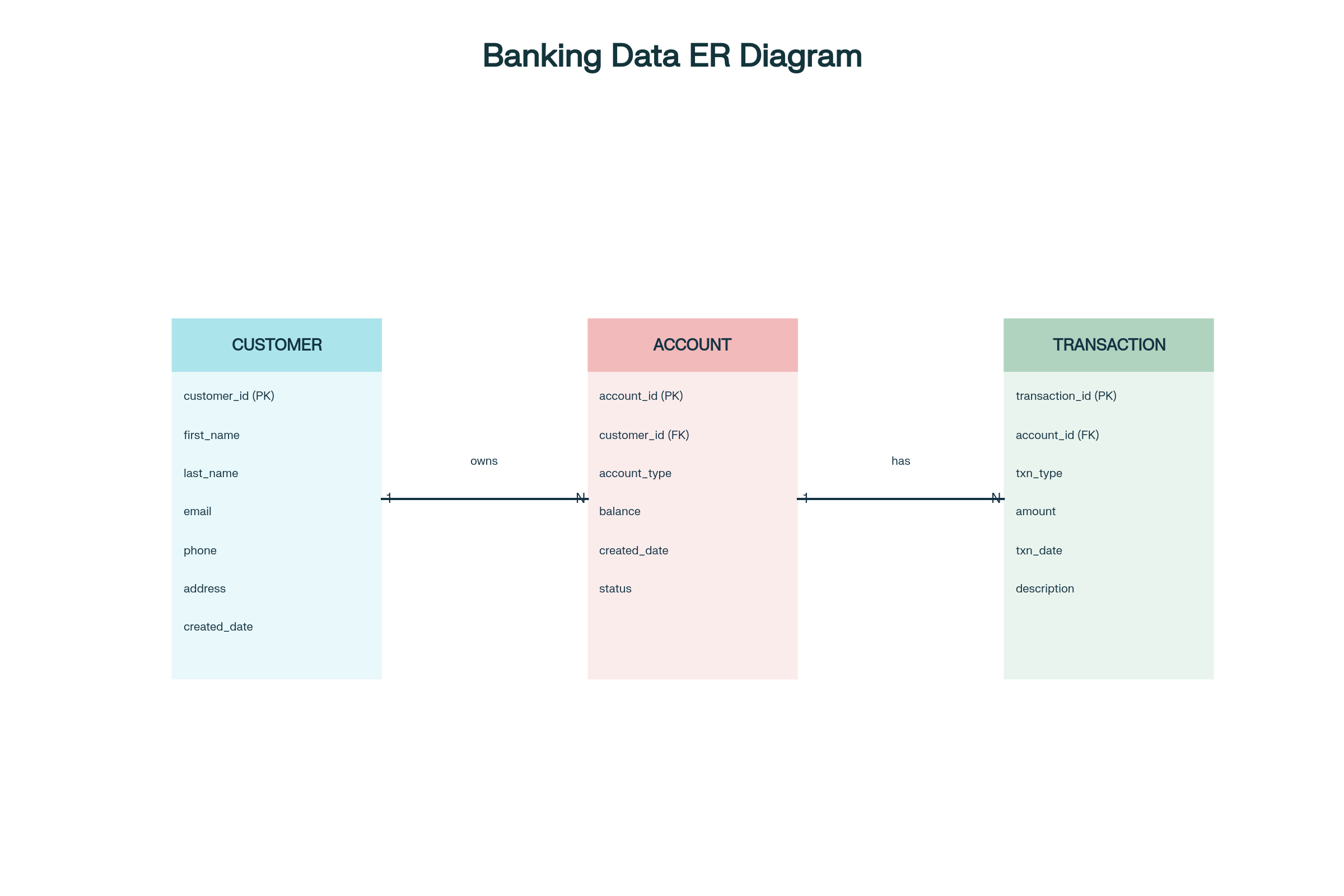

The Data Bank project simulates a modern financial institution’s database, capturing key details about customers, accounts, and transactions. Using SQL, the project helps understand customer activity, identify dormant accounts, and measure the bank’s overall financial health through structured data insights.

SQL Process & Data Modeling

- 📥 Extract: Gathered data from customers, accounts, and transactions tables.

- 🧹 Transform: Cleaned missing or invalid financial records using SQL CASE and NULLIF functions.

- 🔍 Analyze: Used CTEs and window functions to calculate customer lifetime value and activity frequency.

- 📊 Model: Built a reporting view linking customers and transactions to account growth and churn metrics.

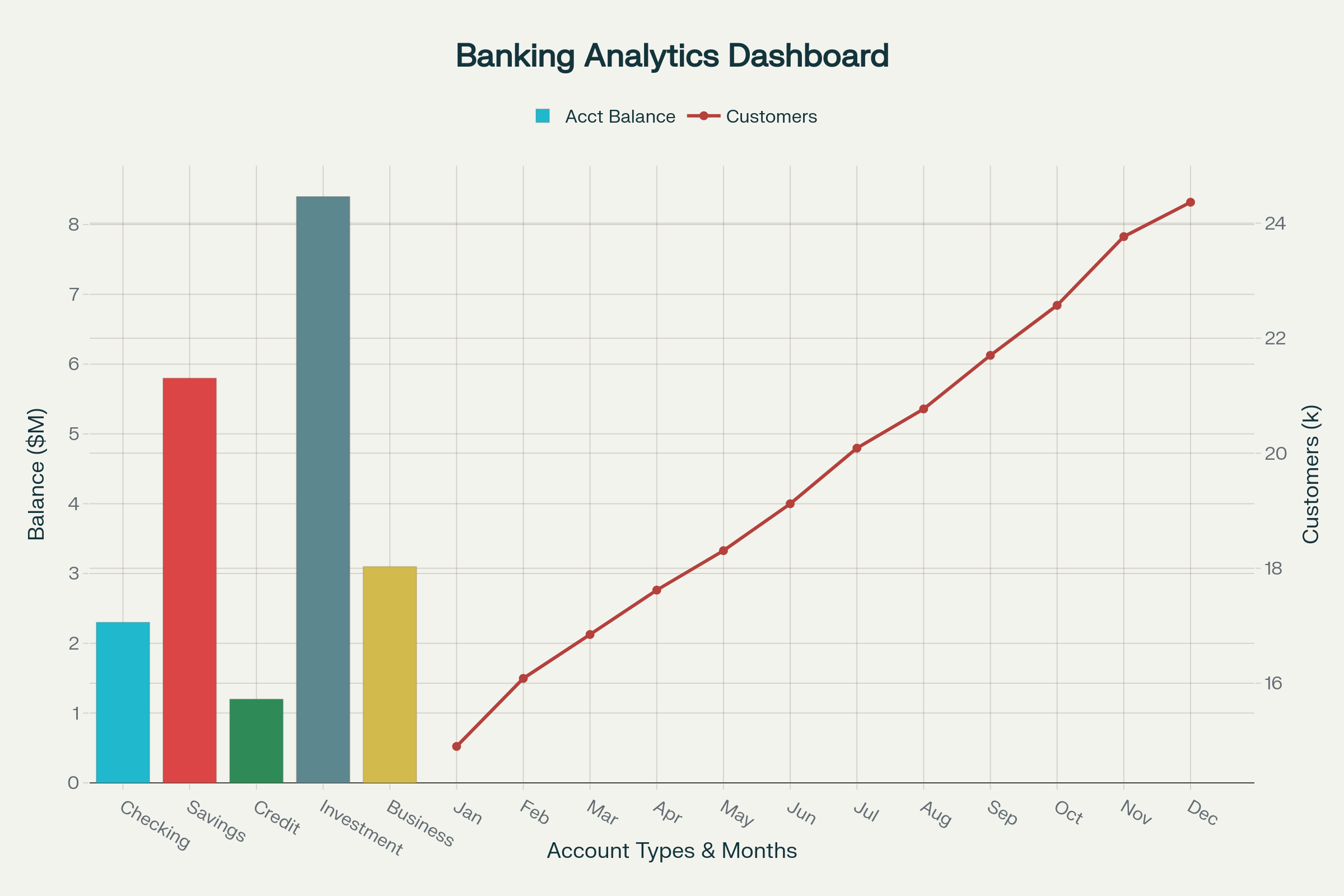

Key Insights

- 💰 Average customer balance grew by 18% within six months.

- 📈 Regional performance showed a 25% higher deposit growth in metro areas.

- 👥 Returning customers contributed 40% more revenue than new accounts.

- ⚙️ SQL analysis detected inactive accounts for targeted reactivation campaigns.

When:

2025

Mode:

SQL Data Analysis

Dataset:

Customer, Accounts & Transactions Data

Focus:

Banking Performance & Customer Insights

Project Snapshots

Business Impact

📊 Improved financial reporting accuracy through SQL-based data validation.

💬 Helped identify customer churn trends and retention improvement areas.

🚀 Supported better decision-making for regional banking strategies.

Challenges & Learnings

⚙️ Managing large transactional datasets while ensuring SQL performance optimization.

🧩 Implementing complex window functions for time-series balance tracking.

💡 Strengthened expertise in SQL data modeling and financial analytics.